Your 2022 To-Do Checklist

Transferring your credit card balance is a great move to make at the start of a new year.

Reasons to transfer a balance:

- Consolidate debt

- Save money with a lower rate

- Take a break from paying interest1

Transferring your balance can be a good financial decision and can help you manage your money.

Reasons to transfer your balance to NWCU:

- We have several credit card options that can work for you or your business

- Lots of digital ways to manage your card

- No limit to the number of transfers you can make

- 0% APR¹ for six months on balance transfers completed between January 1, 2022 and March 31, 2022.² After the promotional 0% APR is over, your APR will return to the range communicated during signup. Variable interest rates range from 6.25% - 17.25% APR.

How to Transfer Your Balance to NWCU

Apply Online

If you’re new to NWCU or you’re a member who’d like to open a new credit card, you can apply online.

Request a Transfer in eBanking

If you’re a current member that already has a credit card, you can request a balance transfer through eBanking and the credit card portal following these steps:

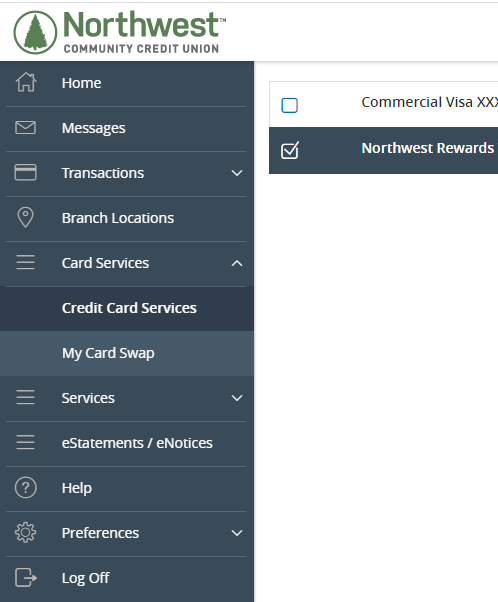

- Log into eBanking at NWCU.com or using your app

- Select Menu and then Card Services

- Select Credit Card Services

- Choose the credit card you want to transfer a balance to

- Click or tap Services and then Balance Transfer

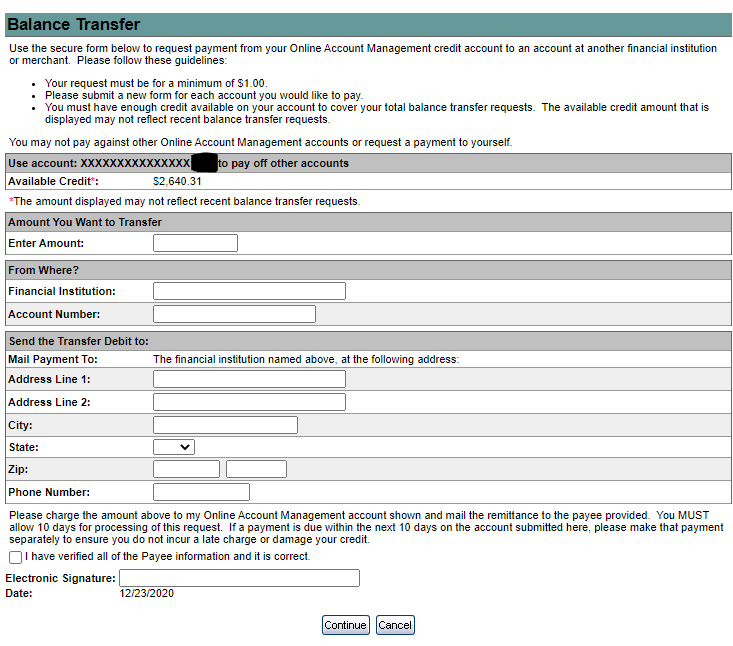

Next, you'll see the Balance Transfer screen. In order to transfer a balance, you'll need to complete this form. Note: The form states that your request must be for a minimum of $1.00, but the 0% APR special requires a $500 balance minimum. So if you transfer less than $500, your transfer won't be eligible for the 0% APR.

Once you fill out the form and enter your electronic signature, click Continue and we'll take it from there!

Apply at the Branch or Over the Phone

You can give us a call at (844) 267-2735 or visit a branch to do a balance transfer. Note that you’ll need to sign a balance transfer authorization form.

¹APR = Annual Percentage Rate. The promotional period will be 0% APR for 6 billing cycles from the date of each transfer. Balance transfers must be completed between January 1, 2022 and March 31, 2022. All loans subject to approval. 0% APR applies to balance transfers from other cards only; purchases and cash advances will be subject to the credit card’s normal rates. Existing NWCU balances not eligible for promotional rate. Minimum transfer is $500. No limit to the number of transfers.

²Minimum transfer is $500. No limit to the number of transfers.

NWCU Visa cards are subject to cash advance fee: $3.00 or 1.50% of the amount of the advance, foreign transaction fee 1.00% of each transaction in U.S. dollars, ATM transaction fee $1.50.