Credit Cards management is essential to your financial readiness. Without proper management, you run the risk of missing payments, negatively impacting your credit score, messing up your budget, and missing chances to save money. Thankfully, you can make your life a little easier with eCS.

Here’s how you can make the most of your credit card.

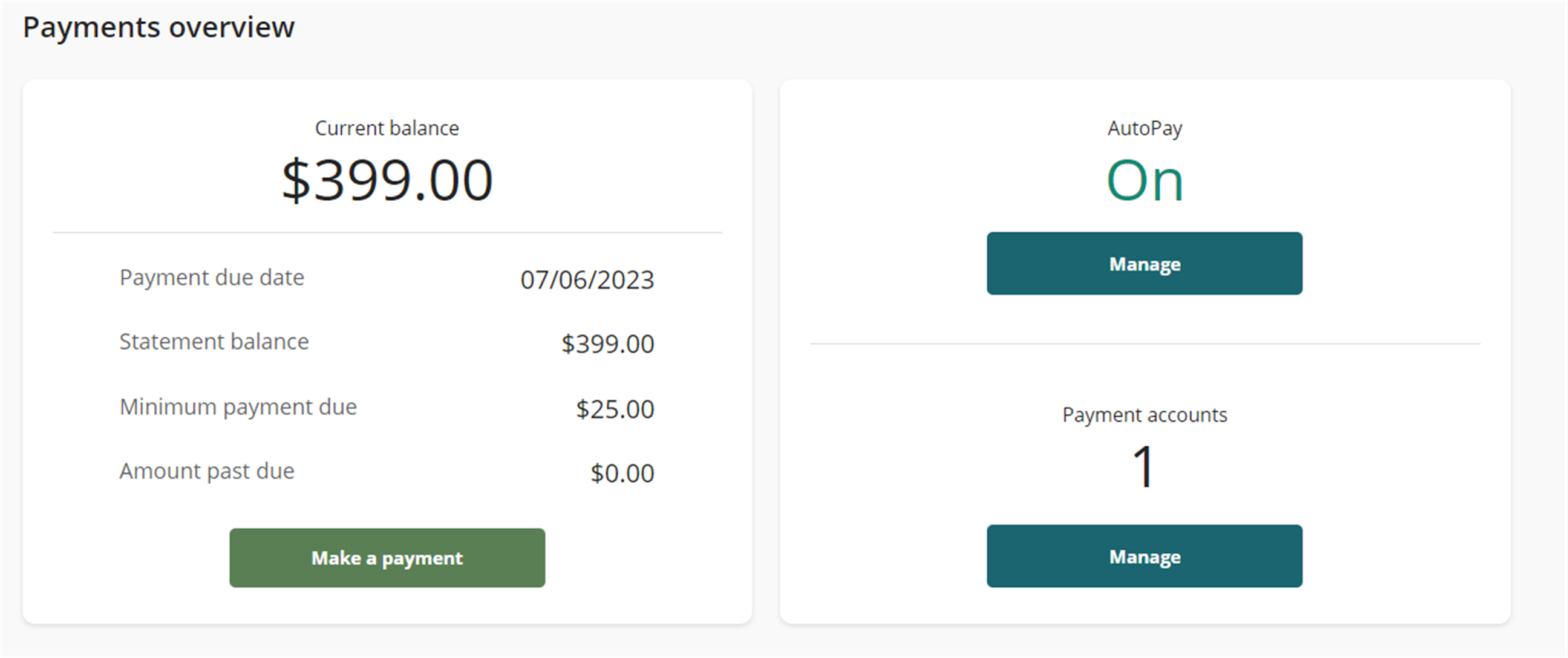

Payments:on-time credit card payments are a big part of your credit score. In fact, up to 30% of your credit score is calculated using your payment history. With tools like automatic payment and eCS, you’ll be able to rest easy knowing that your card is paid on time, every time.

Account History: Credit Card statements are a timeless resource, but with eCS, you can access those statements and find specific transactions much easier. Wondering what day you made a specific purchase? Need to find out exactly how much a vendor charged you? Use eCS to pinpoint exactly what you need.

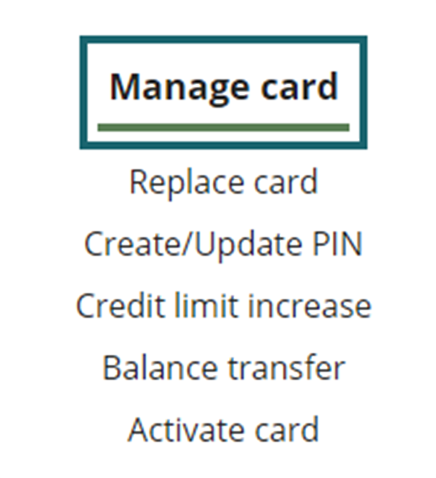

Card Management: eCS card management tools give you more control over your card, its use, and its security. Submit travel plans, block cards that you’ve misplaced, and so much more. And do it all from the convenience of your mobile app or online banking.

SpendTrack for Business Users

SpendTrack offers users a streamlined way to access their credit card account online. While it's tailored to business accounts, non-business users can utilize its convenient features to stay on top of their spending. The NWCU mobile app and online platform are equipped with this powerhouse tool. Here's everything you need to know about it.

SpendTrack Features

Full Control of Credit Cards: Users can shut their credit card off at a moment's notice in the event of potential fraud or to give you time to find it when it's misplaced. But that's only the beginning. With SpendTrack, you can make quick and easy payments to vendors and set up real-time balance alerts, so you'll never be surprised by charges, and you'll be able to do it all from one interactive screen without having to bounce between browser tabs.

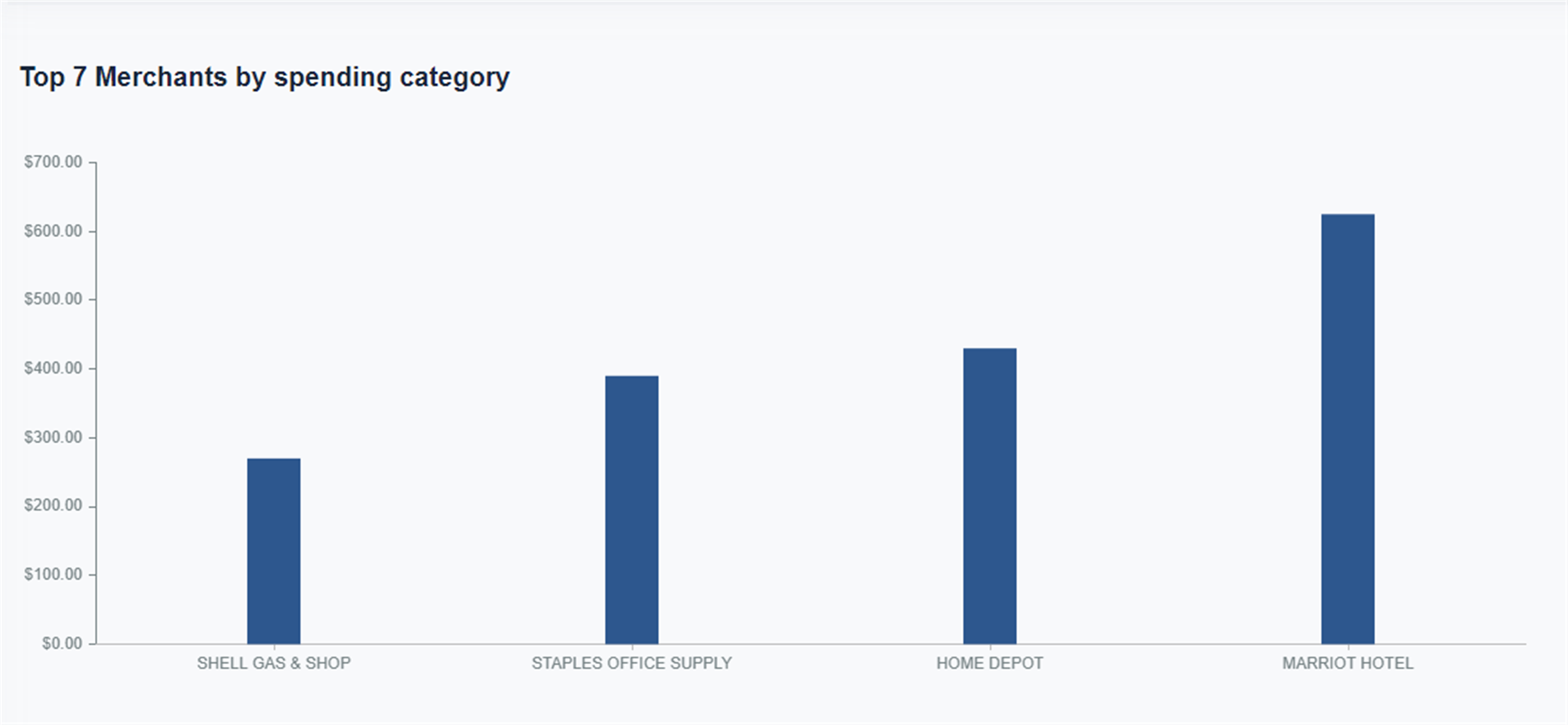

Detailed Transactions: SpendTrack categorizes transactions so you can see exactly how much of your spending goes to bills, entertainment, supplies, groceries, etc. That information makes it easier to set and stick with your budget. It also makes it easier to find specific transactions!

AI-Powered Management System: Business owners complete countless tasks every day. Thankfully, SpendTrack's built-in management systems make completing those tasks easier than ever. From a phone, you can approve payrolls, schedules, and preauthorizations and streamline employee management.

Consumers can use many of SpendTrack's automated features for their own convenience, such as detailed transactions, payment features, and other awesome benefits