Checks aren't as common as they used to be, but are still a safe and convenient way to receive payments or pay debts.

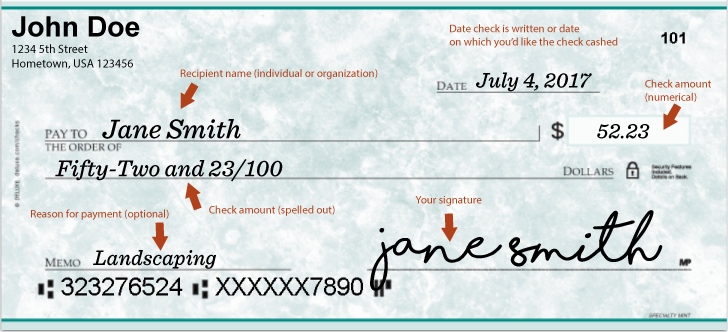

What is a check? Checks are paper forms that people use to transfer money from one place to another. A check is a written order that instructs a financial institution to pay a specific amount of money from a particular checking account to the person or business that the check is written out to.

Why use checks? Checks are a safe and convenient way to pay for things. Having checks means you don’t have to carry around large amounts of cash, or rely on credit cards. Checks also provide you with a detailed record of your purchases. They're especially useful for large purchases (like paying rent every month or a down payment for a car).

How do you get checks? When you open a checking account with Northwest Community Credit Union, you are provided with checks for a fee. You can reorder them at any point from a wide variety of designs.

How do you deposit a check? There are a few different ways you can get that money into your account:

- Deposit the check at a branch.

- Deposit the check at an ATM. Make sure the ATM accepts deposits!

- Use your smartphone to deposit the check by taking a picture with your NWCU mobile app.

Before depositing your check, remember:

- Don't forget to sign the back of the check! Deposits cannot be made without your signature.

- The payee that the check is made out to must be a signer on the account that it is deposited into. Any checks that are deposited into an account on which the payee is not a signer may be rejected.

- Many insurance checks and government checks require that the check be endorsed by all payees before it can be negotiated. Please ensure that any required signatures are on the back of the check before depositing to avoid the check being returned.

- You don't need a deposit slip when completing mobile deposits. Only the front and back image of the check should be captured.

How to order checks from NWCU

NWCU uses Deluxe as our check supplier. You can order checks online, by mail, or by phone. Your checks will arrive in 9 - 14 days if you use Standard Delivery.

Personal checks

To order personal checks, you can:

- Call Deluxe at (877) 838-5287

- Order checks online through your eBanking

Business checks

- Call Deluxe at (800) 328-0304

- Order checks online